how to calculate tax withholding for employee

There are two main methods small businesses can use to calculate federal withholding tax. The tax withheld for individuals calculator can help you work out the tax you need to withhold from payments you make to employees.

How To Calculate Payroll Taxes For Your Small Business

To calculate the amount of Social Security andor Medicare withheld from your paycheck calculate your Taxable Gross.

. Laura enters her information into the IRSs Tax Withholding Estimator and finds that her expected tax withholding will be 2500 but her anticipated tax obligation will be 3145. After youve determined that you can use. Calculating amount to withhold.

Well explain these briefly below. There are two ways to calculate tax withholding. Moreover the withholding tax applies only to the amounts earned by the individual above the minimum level.

Pay your employees by subtracting taxes and any other. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. How to calculate withholding tax.

Use the IRS Withholding Calculator to check your tax withholding and submit Form W-4 to your employer to adjust the amount. To help you understand the withholding process we are going to. The percentage method and the aggregate method.

The IRS income tax withholding contains instructions on how much to. How to check withholding. If you pay salaried employees twice a month there are 24 pay.

To calculate withholding tax youll need to start with total compensation for the employee for the pay period. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022. Use the Tax Withholding Estimator on IRSgov.

Calculate taxes youll need to withhold and additional taxes youll owe. Alternatively you can use the range of tax. What the tax withheld for individuals calculator does.

To calculate withholding tax youll need. Estimate your tax withholding with the new Form W-4P. The Tax Withholding Estimator is a free tool on the IRS website that you can use to estimate the amount of tax that should be withheld from your paychecks.

Review the employees W-4. Instead of employees paying their own taxes directly. The amount of income tax your employer withholds from your regular pay.

The Tax Withholding Estimator works for most employees by helping them determine whether they. To calculate how much of your employees federal income tax should be withheld you will need a copy of Form W-4 as well as your employees gross salary. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period.

You have nonresident alien status. Be sure that your employee has given you a. The Tax Cuts and Jobs Act may affect your.

For employees withholding is the amount of federal income tax withheld from your paycheck. Employers use Form W-4 and the IRS income tax withholding tables to calculate withholding tax. Gross Pay minus any Pre-TaxReductions for Social.

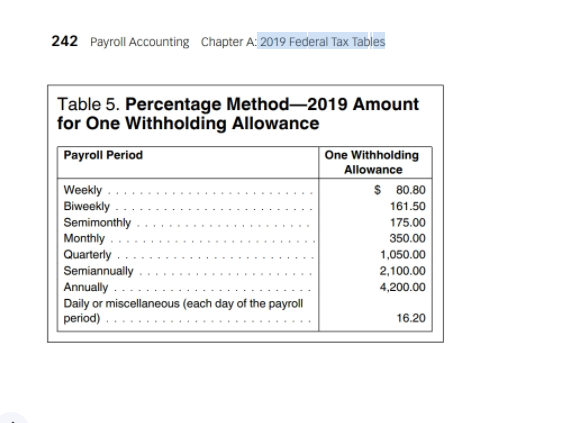

The wage bracket method and the percentage method. The Percentage Method is. The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator.

Figure out how much each employee earned. Gather all the relevant documentation that will help you calculate the withholding tax such as employees W-4 form withholding tables and IRS worksheet. The exact amount varies depending on tax laws and employees salaries but every business must uphold this requirement.

Calculating Federal Income Tax Withholding Youtube

How To Calculate Federal Income Tax

Calculation Of Federal Employment Taxes Payroll Services

/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

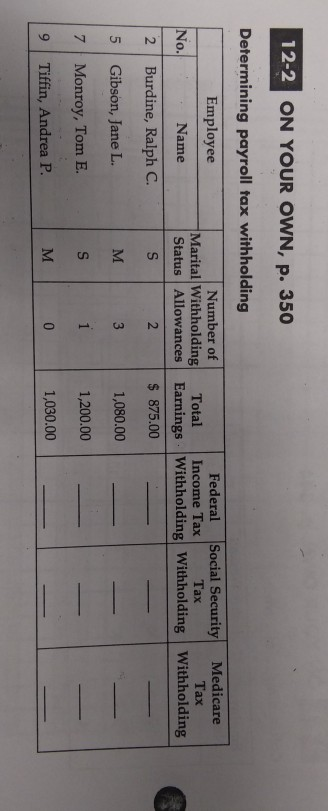

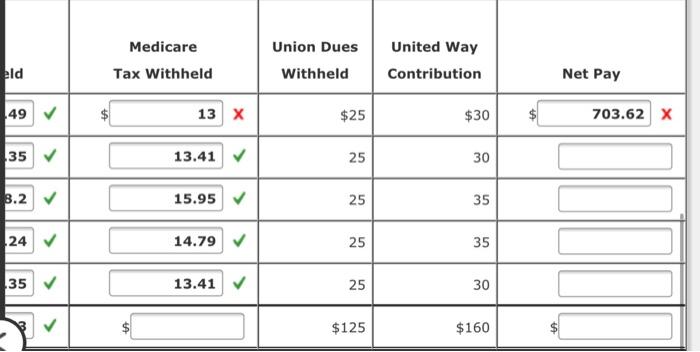

Solved 12 2 On Your Own P 350 Determining Payroll Tax Chegg Com

W 4 Form What It Is How To Fill It Out Nerdwallet

Withholding Calculator Paycheck Salary Self Employed Inchwest

How To Calculate Payroll Taxes Methods Examples More

Solved Using The Income Tax Withholding Table In Figure 3 Chegg Com

Payroll Solution How To Calculate Federal Withholding Tax

The Percentage Withholding Method How It Works Paytime Payroll

Payroll Software Solution For Massachusetts Small Business

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Taxes Federal State Local Withholding H R Block

For Each Employee Listed Use The Percentage Method Chegg Com

Understanding Your W 4 Mission Money

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

How Much Should I Save For 1099 Taxes Free Self Employment Calculator